A Biased View of Tax Accountant In Vancouver, Bc

Wiki Article

Top Guidelines Of Virtual Cfo In Vancouver

Table of ContentsHow Tax Consultant Vancouver can Save You Time, Stress, and Money.Examine This Report about Vancouver Accounting FirmSmall Business Accountant Vancouver for DummiesThe Only Guide for Virtual Cfo In Vancouver

That happens for every single deal you make throughout a given accounting duration. Functioning with an accounting professional can aid you hash out those information to make the bookkeeping procedure work for you.

You make modifications to the journal entrances to make sure all the numbers add up. That might consist of making corrections to numbers or handling built up products, which are costs or earnings that you incur yet don't yet pay for.

Accountants and accounting professionals take the same foundational audit training courses. This guide will certainly supply a detailed break down of what divides accountants from accountants, so you can recognize which accountancy function is the ideal fit for your profession desires currently as well as in the future.

Some Ideas on Small Business Accountant Vancouver You Need To Know

An accountant constructs on the details given to them by the bookkeeper. Commonly, they'll: Review monetary statements prepared by a bookkeeper. Examine, interpret or prove to this info. Turn the details (or records) right into a report. Share guidance and also make recommendations based upon what they have actually reported. The records reported by the accountant will identify the accounting professional's advice to management, as well as eventually, the health and wellness of business on the whole.e., federal government agencies, colleges, healthcare facilities, and so on). A well-informed and proficient bookkeeper with years of experience and also first-hand understanding of audit applications ismost likelymore certified to run guides for your organization than a current accounting major graduate. Keep this in mind when filtering applications; try not to judge candidates based on their education alone.

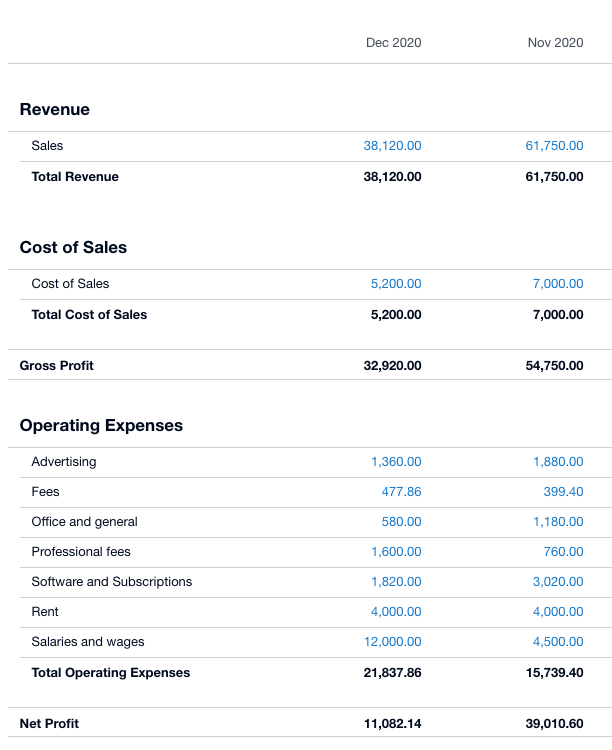

Service estimates as well as trends are based on your historical monetary data. The financial data is most trustworthy as well as precise when given with a robust and also structured audit process.

How Vancouver Tax Accounting Company can Save You Time, Stress, and Money.

Bookkeeping, in the conventional sense, has actually been about as long as there has been business given that around 2600 B.C. A bookkeeper's job is to preserve total records of all cash that has entered and gone out of business - virtual CFO in Vancouver. Bookkeepers record everyday transactions in a consistent, easy-to-read means. Their documents enable accountants to do their tasks.Normally, an accountant or owner oversees a bookkeeper's work. An accountant is not an accountant, neither must they be thought about an accounting professional.

Three major variables influence your find more expenses: the services you want, the know-how you require and your regional market. The bookkeeping solutions your service needs as well as the quantity of time it takes once a week or month-to-month to finish them affect just how much it costs to work with a bookkeeper. If you need somebody to find to the office when a month to integrate the publications, it will certainly set you back much less than if you require to hire somebody permanent to manage your everyday procedures.

Based upon that estimation, choose if up accountent you need to employ somebody permanent, part-time or on a task basis. If you have complex books or are bringing in a lot of sales, hire a qualified or accredited bookkeeper. An experienced bookkeeper can provide you satisfaction and also self-confidence that your funds remain in good hands however they will certainly likewise cost you more.

Small Business Accountant Vancouver - Truths

If you reside in a high-wage state fresh York, you'll pay even more for a bookkeeper than you would in South Dakota. According to the Bureau of Labor Stats (BLS), the nationwide average wage for accountants in 2021 was $45,560 or $21. 90 per hr. There are numerous benefits to employing an accountant to file and also document your business's financial records.

They might pursue additional certifications, such as the CPA. Accounting professionals may also hold the setting of bookkeeper. If your accounting professional does your accounting, you may be paying more than you need to for this solution as you would usually pay even more per hour for an accounting professional than a bookkeeper.

To finish the program, accounting professionals have to have 4 years of appropriate job experience. CFAs need to also pass a difficult three-part visit the website exam that had a pass price of just 39 percent in September 2021 - CFO company Vancouver. The factor right here is that employing a CFA means bringing highly advanced bookkeeping expertise to your organization.

To get this accreditation, an accountant needs to pass the called for exams as well as have 2 years of expert experience. CPAs can perform several of the very same solutions as CIAs. You could employ a CIA if you want an extra specialized focus on monetary threat evaluation and protection surveillance processes. According to the BLS, the typical wage for an accounting professional in 2021 was $77,250 annually or $37.

Report this wiki page